Right first post so bear with me.

I took out a together mortgage with Northern Rock in 2002. The secured part of the mortgage was repaid in 2003 when I moved home. However the unsecured loan was left as an unsecured loan and I made payments until around 2004-2005.

Somehow at this point Northern Rock stopped collecting payments. I don't know why and too be honest I accepted it for a while as the extra money per month came in handy.

In 2008, Northern Rock wrote to me saying that payments had been missed etc and that although they were at fault for it I had to take some responsibility as I should of been aware that payments weren't being made. They offered to add the payments to the loan and waive all interest for the period.

I didn't accept this and decided to request the CCA for the loan. I basically thought at this point if I got the CCA I may be able to baragin with the loan on my terms. I know the unsecured loan if it wasn't connected to the mortgage would be at a rate of 5% above their base rate.

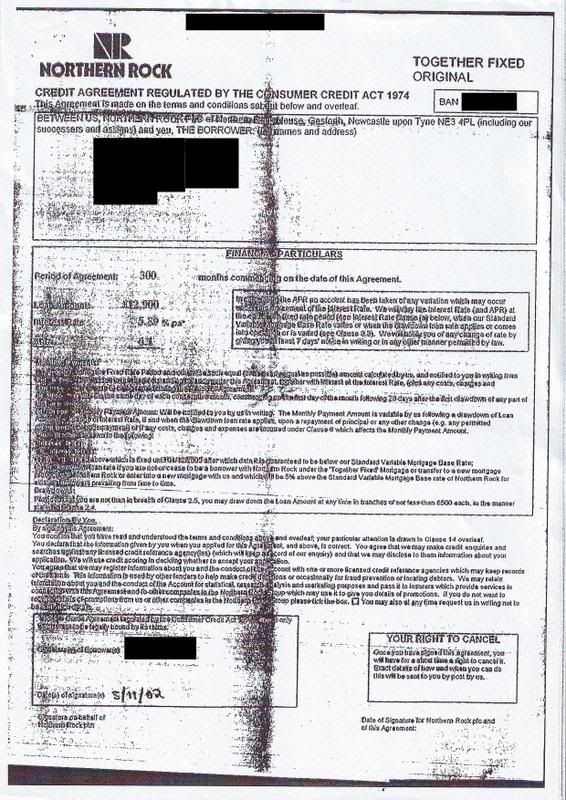

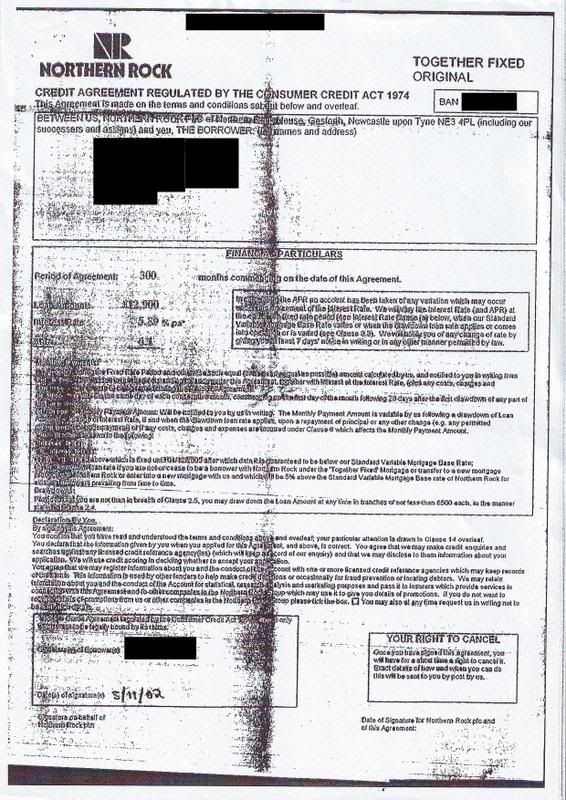

This is what I got back

As you can see it was unreadable. I noticed what you could make out was the rate of 5.89% but the part where it says if the main mortgage was repaid then the unsecured loan would be 5% above. also the balance for the original amount was £12,900 but the amount they claimed was owed was now higher and has been getting higher each month. It's up over £18k now.

I wrote to them and said it was unenforceable because it was inlegible and that the rate they are charging is higher than what is on the CCA.

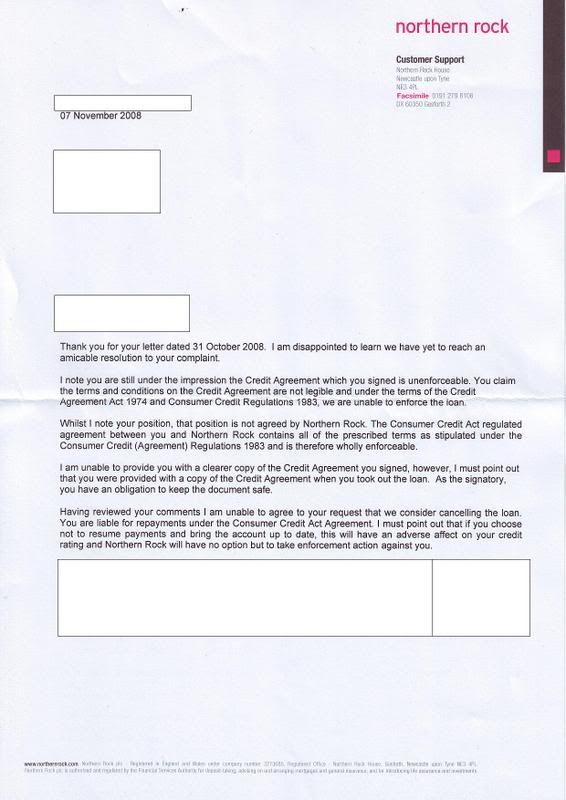

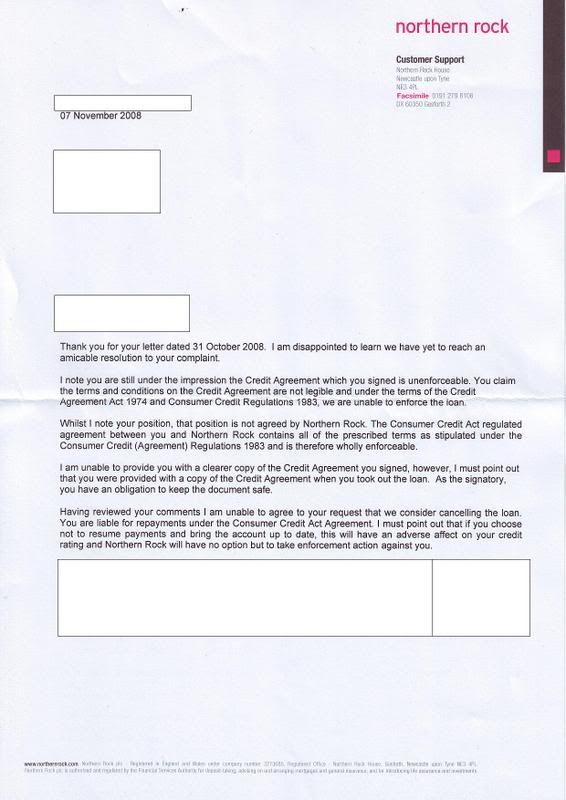

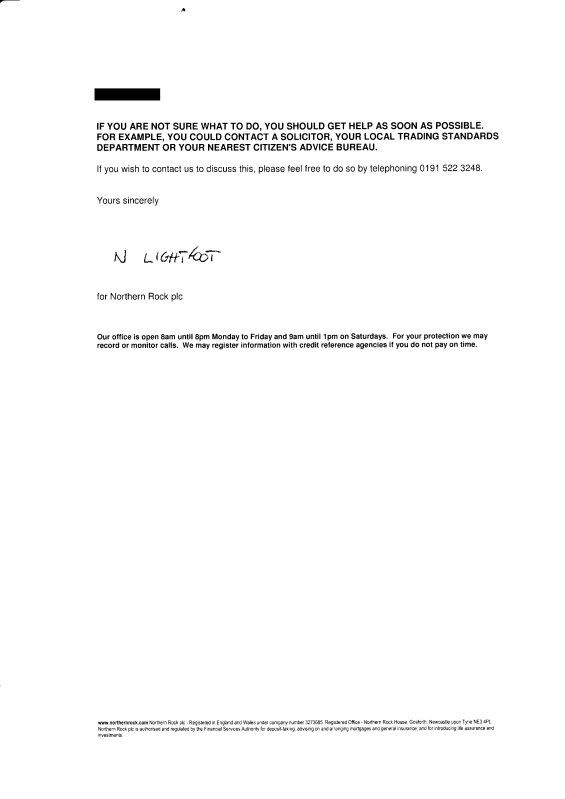

I got this back

I basically wrote back saying I didn't agree and the account is in dispute. They had confirmed in that above letter that they couldn't provide a clearer copy. So presumably they have destroyed the original.

I didn't make any more payments and left it at that.

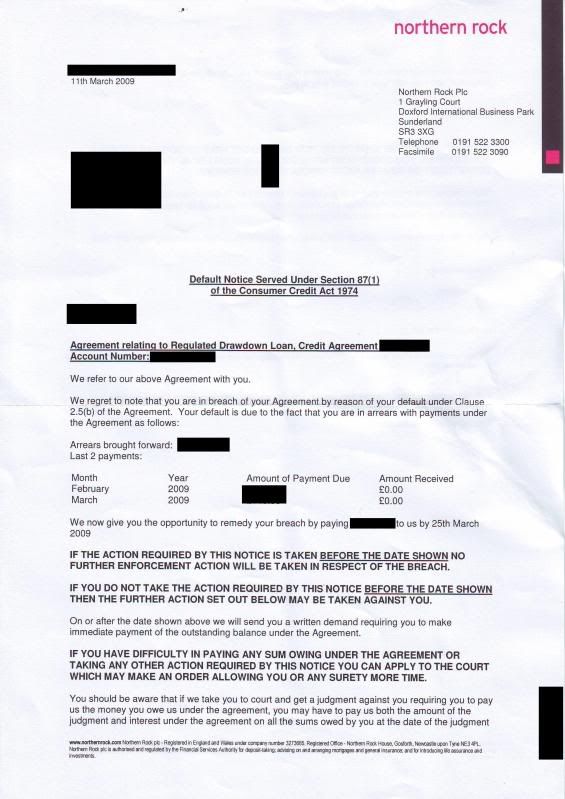

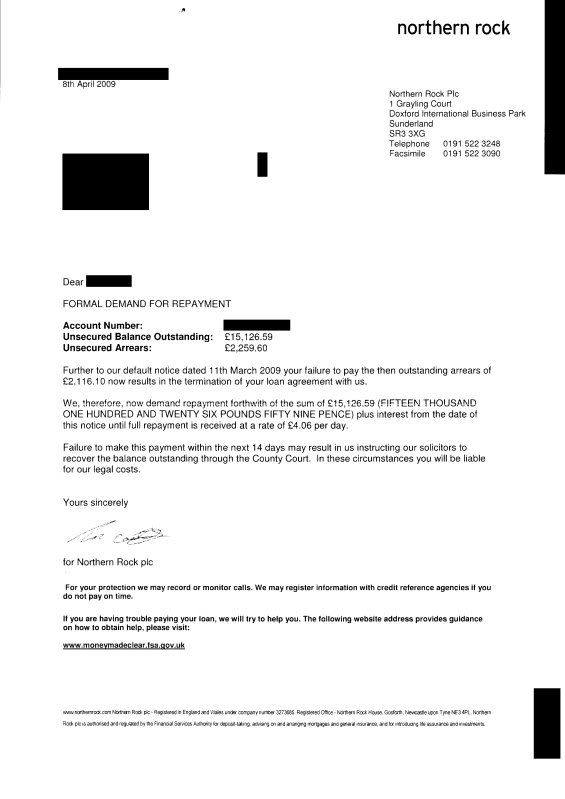

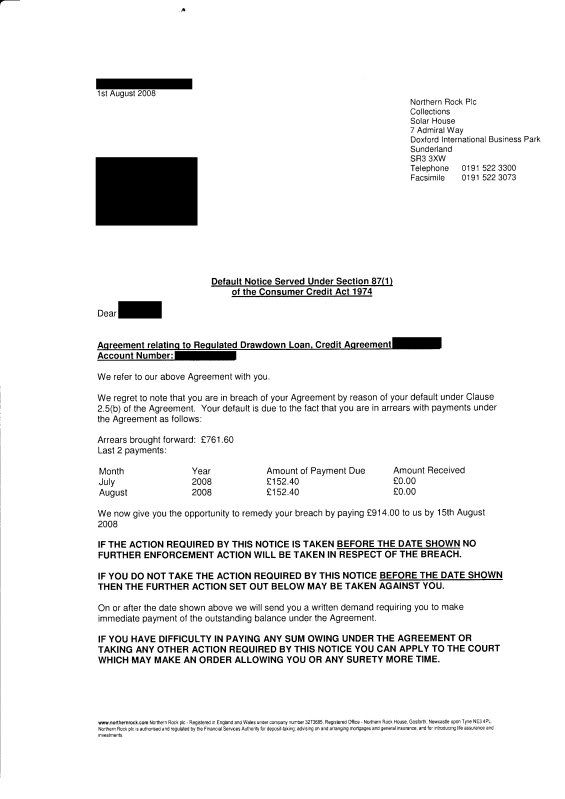

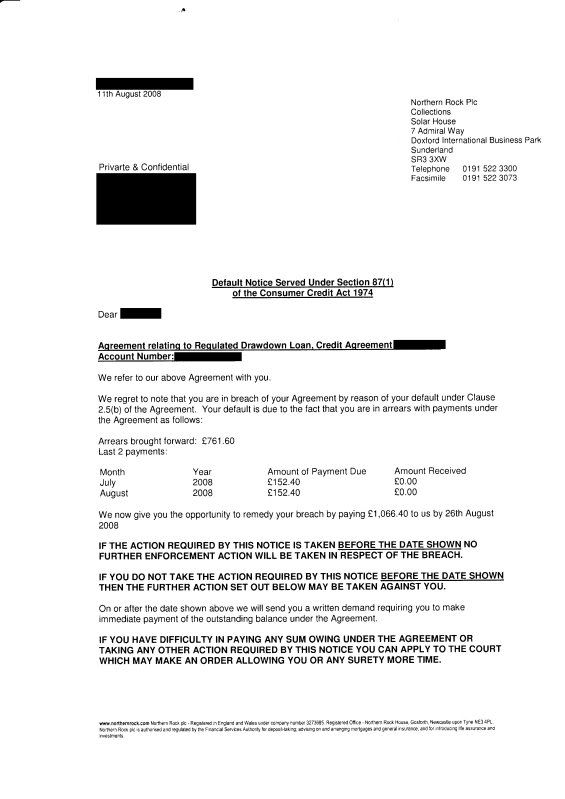

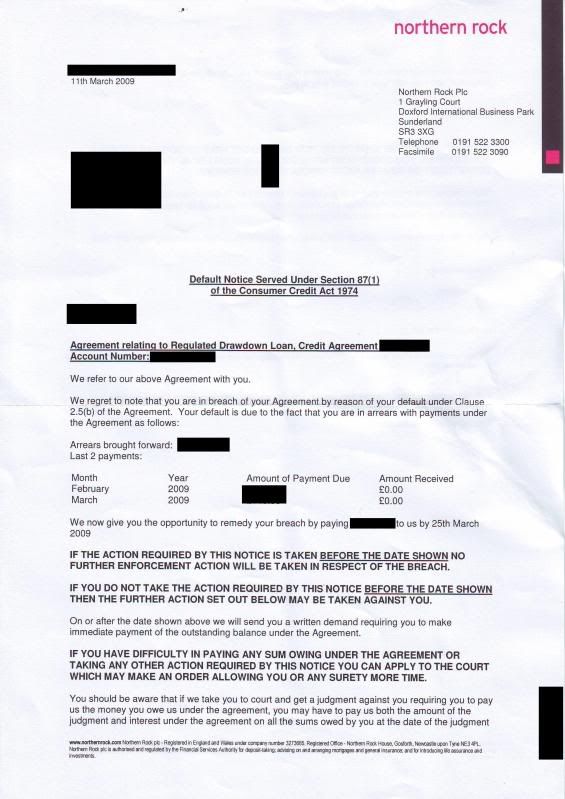

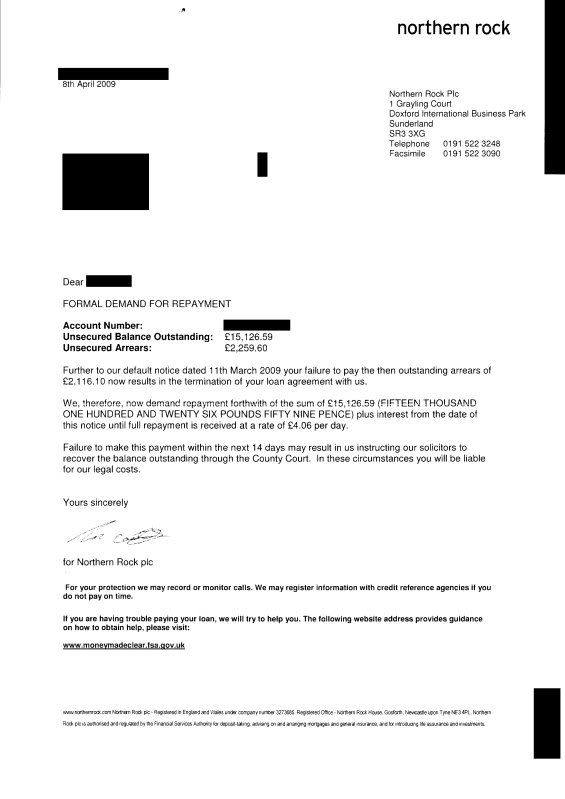

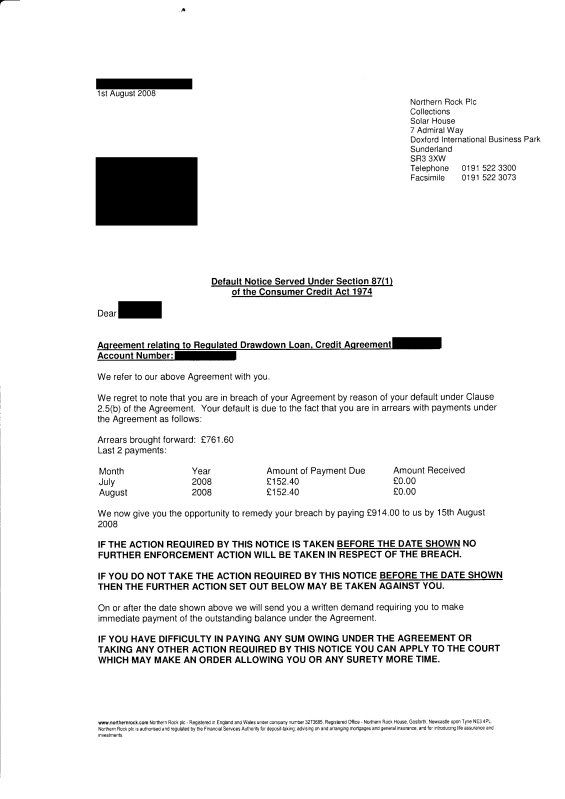

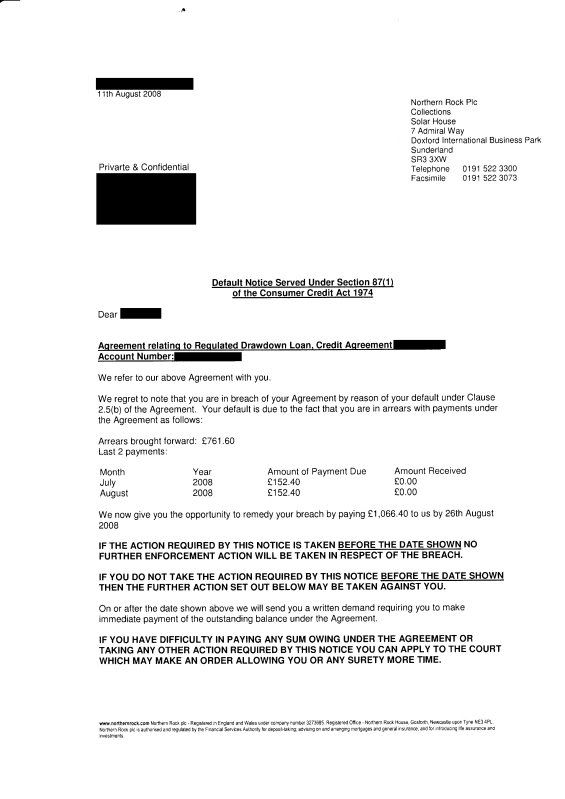

Then I started to get default notices and formal demands, as in more than one.

Each time I wrote to them saying account in dispute and they just basically ignored me and I geared myself up to go to court for it. It never happened.

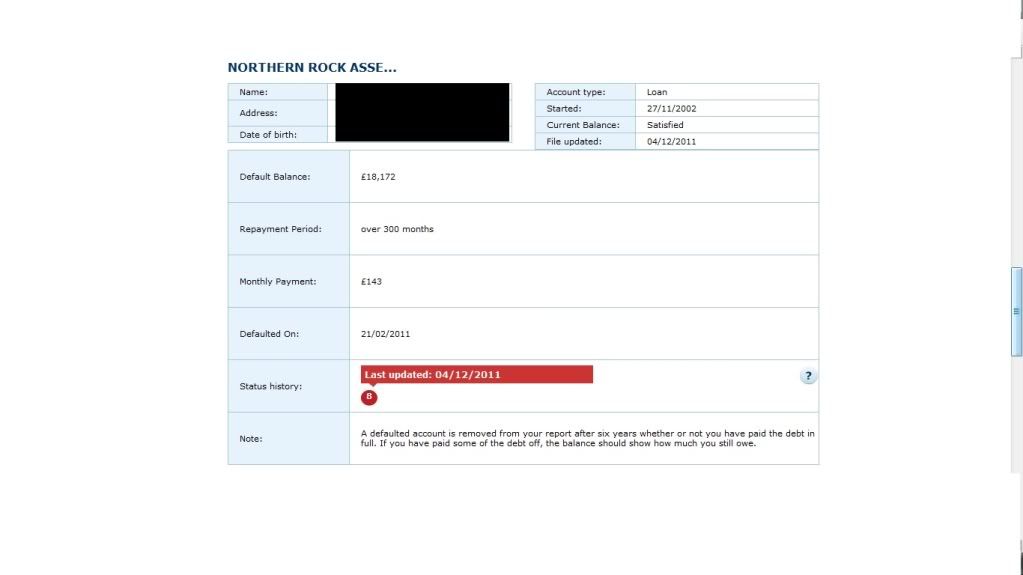

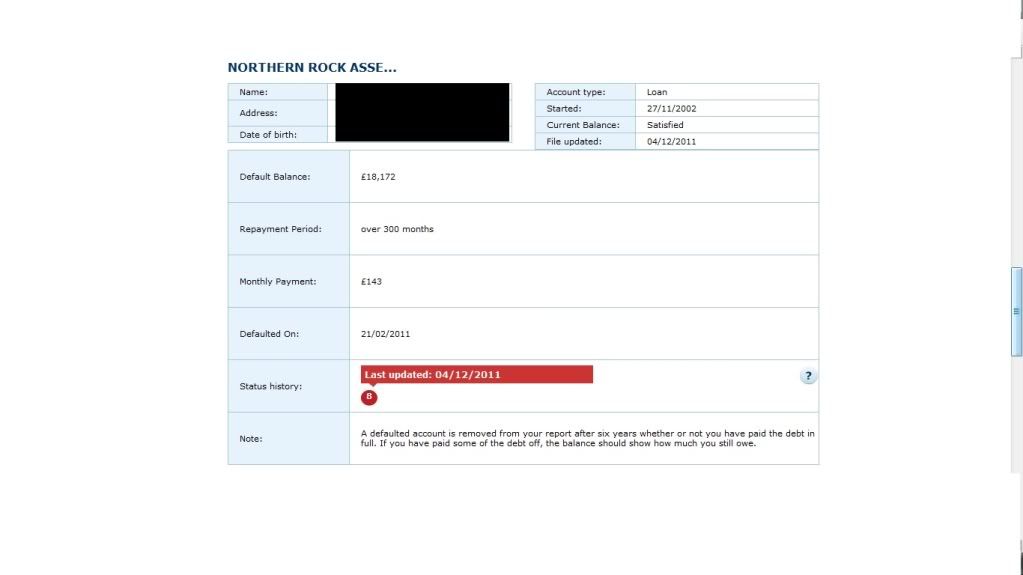

That is how it has been going until a few months ago. I was checking my Experian file and noticed this

They have marked it settled but if you notice the date it was updated, it was Dec 2011. They are updating it each month. I'm hoping this means that they have finally given up on the account. It must also be stature barred by now, which I believe could be the reason they have given up.

The other thing I noticed is that they have defaulted the account on the 21/02/2011. So I'm stuck with the default on my credit file until Feb 2017, despite being defaulted on it a few times.

Is there anything I can do about this to get it removed altogether?

I took out a together mortgage with Northern Rock in 2002. The secured part of the mortgage was repaid in 2003 when I moved home. However the unsecured loan was left as an unsecured loan and I made payments until around 2004-2005.

Somehow at this point Northern Rock stopped collecting payments. I don't know why and too be honest I accepted it for a while as the extra money per month came in handy.

In 2008, Northern Rock wrote to me saying that payments had been missed etc and that although they were at fault for it I had to take some responsibility as I should of been aware that payments weren't being made. They offered to add the payments to the loan and waive all interest for the period.

I didn't accept this and decided to request the CCA for the loan. I basically thought at this point if I got the CCA I may be able to baragin with the loan on my terms. I know the unsecured loan if it wasn't connected to the mortgage would be at a rate of 5% above their base rate.

This is what I got back

As you can see it was unreadable. I noticed what you could make out was the rate of 5.89% but the part where it says if the main mortgage was repaid then the unsecured loan would be 5% above. also the balance for the original amount was £12,900 but the amount they claimed was owed was now higher and has been getting higher each month. It's up over £18k now.

I wrote to them and said it was unenforceable because it was inlegible and that the rate they are charging is higher than what is on the CCA.

I got this back

I basically wrote back saying I didn't agree and the account is in dispute. They had confirmed in that above letter that they couldn't provide a clearer copy. So presumably they have destroyed the original.

I didn't make any more payments and left it at that.

Then I started to get default notices and formal demands, as in more than one.

Each time I wrote to them saying account in dispute and they just basically ignored me and I geared myself up to go to court for it. It never happened.

That is how it has been going until a few months ago. I was checking my Experian file and noticed this

They have marked it settled but if you notice the date it was updated, it was Dec 2011. They are updating it each month. I'm hoping this means that they have finally given up on the account. It must also be stature barred by now, which I believe could be the reason they have given up.

The other thing I noticed is that they have defaulted the account on the 21/02/2011. So I'm stuck with the default on my credit file until Feb 2017, despite being defaulted on it a few times.

Is there anything I can do about this to get it removed altogether?

Comment