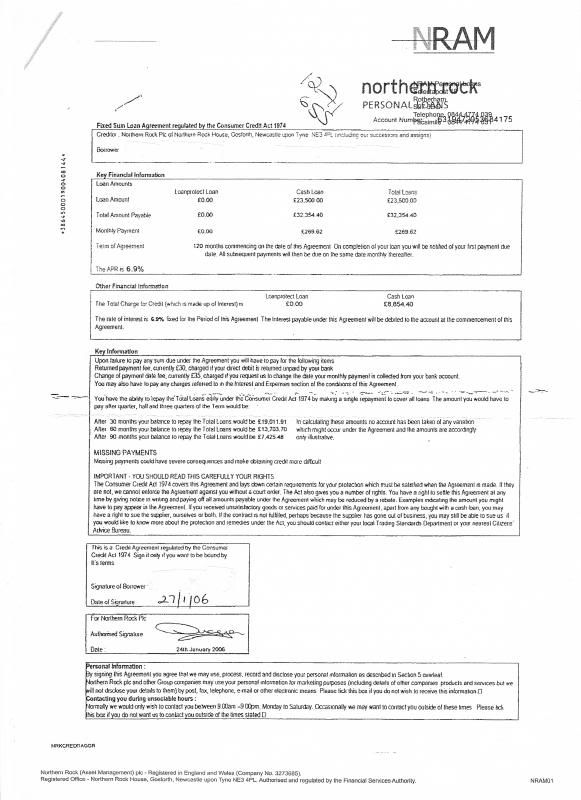

I have a Northern Rock loan account that I haven't paid into since December 2009 after I was told by Eastleys Solicitors in Paignton that the loan agreement was UE. However, I have since been informed by Niddy that the debt is in fact enforceable! The account has been passed to various DCAs but I have not replied to any letter received from any of the DCAs and acknowledged the debt. The most recent DCA was Allied or AIC who made a settlement offer of approx. £9000 for my £23000 debt. I have received a letter from Northern Rock (NRAM) this week stating they have recalled the debt from Allied and that their Internal Loss Recovery Unit are dealing with the outstanding debt. They have stated that if they fail to contact me they will:

(i) instruct a differnt DCA

(ii) take legal action to have payments towards the debt deducted from my salary

(iii) a CCJ against me and a 'Charge' against my assets

(iv) petition for bankruptcy

(v) consider other legal action to recover the debt

(vi) sell my debt to a debt purchaser

Does anyone else have experience of this from NRAM. What do you think their most likely course of action will be? I am holding out from statute barred in December 2014. Will I make it???

All advice/help gratefully received. Thanks.

(i) instruct a differnt DCA

(ii) take legal action to have payments towards the debt deducted from my salary

(iii) a CCJ against me and a 'Charge' against my assets

(iv) petition for bankruptcy

(v) consider other legal action to recover the debt

(vi) sell my debt to a debt purchaser

Does anyone else have experience of this from NRAM. What do you think their most likely course of action will be? I am holding out from statute barred in December 2014. Will I make it???

All advice/help gratefully received. Thanks.

Comment