Understanding PPI Calculations--- Loan Amortization

Before you study the other threads in this sub-forum it is necessary to understand the basics on how a typical personal loan is scheduled throughout its life. This thread is basically to explain Loan Amortization in simple terms – I apologise to those familiar with the concept and if I am attempting to teach grandmother..eggs scenario, and I also apologise if I do not use the correct financial terms – but as most of you know, I am more of a Technician rather than a Financial Guru.

I have previously posted this work on PenaltychargesForum, Penaltyactiongroup and Legal Beagles, this thread is a further development on the same theme.

When we come to discuss PPI mis-selling - the concepts described in this thread are equally applicable to either a Loan for a Cash Advance or a Loan for a PPI Single Premium Insurance.

Previously, before the law changed to make the lender issue at least an annual statement, customers often (especially Firstplus) had nothing for up to 3 years, the only way Bill & I could derive a settlement figure was to use Loan Amortization and then add a bit-say 2 months interest. (before Marshallka clarified how to use Rule of 78 Calculations ) - However, those sums were assuming fixed interest.

We then progressed with coaxing out the %'ge increase letters from the customer ( who usually had thrown them away) and effectively calculating the variable interest and a correct outstanding balance.

Nowadays, it is fairly easy to get your statements (unfortunately though for Pompeyfaith, Co-Op are the exception)

So we won't be using Amortization very much later on, but I think it useful that everybody understands loan scheduling.

First of all, I would like to clear up a couple of mis-conceptions that frequently crop up on these type of forums, as very often people are taken by surprise when they examine their loan balances and see that, in the early days, nearly all the payment is going on interest and not the principal.

On an original agreement, the figures quoted always include:

These are figures taken at a snapshot in timeon the day the agreement was signed. Their main purpose is to allow customers to compare loans from different lenders as each lender by law has to present the figures in this way.

However, the vast majority of loans are on a variable rateand are subject to frequent increases and infrequent decreases in the interest rate, rendering the original quoted TCC and TAP practically obsolete.

Therefore, when we start studying the figures for loans subject to PPI mis-selling, we must work at a far more detailed level and effectively understand an amortization schedule for the loan.

Amortization

Amortization is a method for repaying a loan in equal installments. Part of each payment goes toward interest due for the period and the remainder is used to reduce the principal (the loan balance). As the balance of the loan is gradually reduced, a progressively larger portion of each payment goes toward reducing principal.

Amortization Schedule

An amortization schedule is a table with a row for each payment period of an amortized loan. Each row shows the amount of the payment that is needed to pay interest, the amount that is used to reduce principal, and the balance of the loan remaining at the end of the period.

Negative Amortization

Negative amortization occurs when the payment is not large enough to cover the interest due for a period. This will cause the loan balance to increase after each payment - a situation that should certainly be avoided. This might occur, for instance, if the rate of a variable-rate loan increases, but the payment does not.

Interest

In practice, the Lenders have various ways of actually calculating interest-a selection below:

However in order to illustrate the concepts within this thread, I am going to assume the following simple scenario:

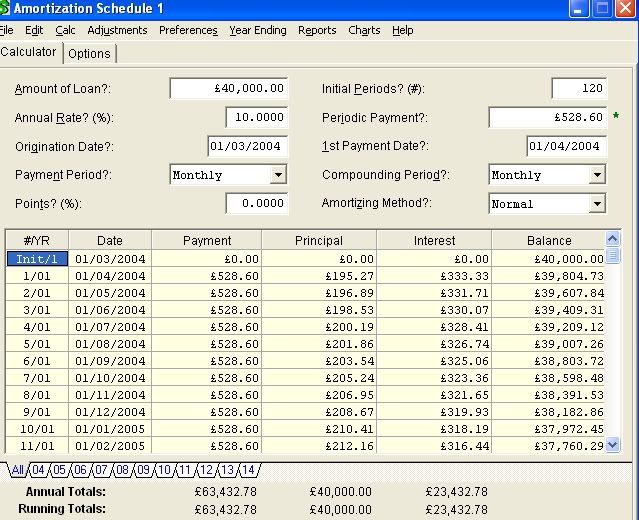

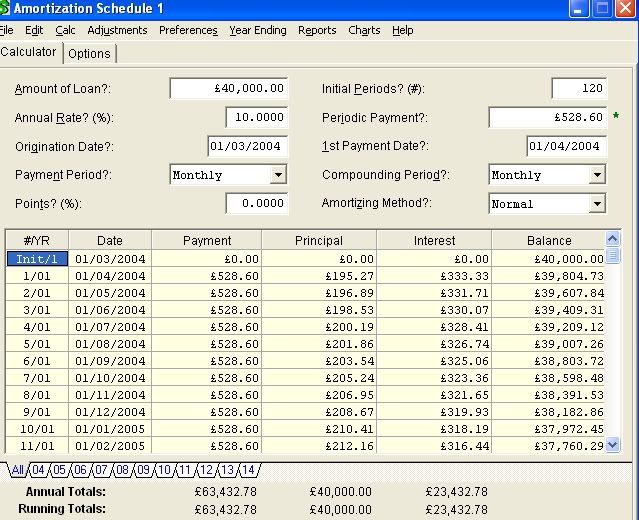

In the first Illustration below - note how the Principal part of the Payment increases in the first 11 months of the Loan and the Interest decreases.

This is because the interest is calculated on the previous month's outstanding balance which is gradually decreasing.

This is illustrated below which shows the part of the £528.60 monthly payment that is attributed towards paying off the loan and paying the interest on the loan - note how the ratio changes towards the end of the Loan.

Before you study the other threads in this sub-forum it is necessary to understand the basics on how a typical personal loan is scheduled throughout its life. This thread is basically to explain Loan Amortization in simple terms – I apologise to those familiar with the concept and if I am attempting to teach grandmother..eggs scenario, and I also apologise if I do not use the correct financial terms – but as most of you know, I am more of a Technician rather than a Financial Guru.

I have previously posted this work on PenaltychargesForum, Penaltyactiongroup and Legal Beagles, this thread is a further development on the same theme.

When we come to discuss PPI mis-selling - the concepts described in this thread are equally applicable to either a Loan for a Cash Advance or a Loan for a PPI Single Premium Insurance.

Previously, before the law changed to make the lender issue at least an annual statement, customers often (especially Firstplus) had nothing for up to 3 years, the only way Bill & I could derive a settlement figure was to use Loan Amortization and then add a bit-say 2 months interest. (before Marshallka clarified how to use Rule of 78 Calculations ) - However, those sums were assuming fixed interest.

We then progressed with coaxing out the %'ge increase letters from the customer ( who usually had thrown them away) and effectively calculating the variable interest and a correct outstanding balance.

Nowadays, it is fairly easy to get your statements (unfortunately though for Pompeyfaith, Co-Op are the exception)

So we won't be using Amortization very much later on, but I think it useful that everybody understands loan scheduling.

First of all, I would like to clear up a couple of mis-conceptions that frequently crop up on these type of forums, as very often people are taken by surprise when they examine their loan balances and see that, in the early days, nearly all the payment is going on interest and not the principal.

- the amount of interest payable each month is not linear – ie constant.

- the Total Amount Payable (TAP) is only a snapshot in time and changes with the interest rate %’ge.

On an original agreement, the figures quoted always include:

- Total Charge for Credit (TCC)

- Total Amount Payable (TAP)

- Apr %

These are figures taken at a snapshot in timeon the day the agreement was signed. Their main purpose is to allow customers to compare loans from different lenders as each lender by law has to present the figures in this way.

However, the vast majority of loans are on a variable rateand are subject to frequent increases and infrequent decreases in the interest rate, rendering the original quoted TCC and TAP practically obsolete.

Therefore, when we start studying the figures for loans subject to PPI mis-selling, we must work at a far more detailed level and effectively understand an amortization schedule for the loan.

Amortization

Amortization is a method for repaying a loan in equal installments. Part of each payment goes toward interest due for the period and the remainder is used to reduce the principal (the loan balance). As the balance of the loan is gradually reduced, a progressively larger portion of each payment goes toward reducing principal.

Amortization Schedule

An amortization schedule is a table with a row for each payment period of an amortized loan. Each row shows the amount of the payment that is needed to pay interest, the amount that is used to reduce principal, and the balance of the loan remaining at the end of the period.

Negative Amortization

Negative amortization occurs when the payment is not large enough to cover the interest due for a period. This will cause the loan balance to increase after each payment - a situation that should certainly be avoided. This might occur, for instance, if the rate of a variable-rate loan increases, but the payment does not.

Interest

In practice, the Lenders have various ways of actually calculating interest-a selection below:

- Simple/Compound

- Daily/Weekly/Monthly/4-weekly/Etc

- assuming 360 days a year/365days a year/365.25 days a year/366 days a year/etc

- Variable Rate/Fixed Rate

- And various ways of Amortizing the Loan:--Normal/Fixed Payment/Canadian/Interest Only/Rule of 78/No interest (if you can find it-lol)

However in order to illustrate the concepts within this thread, I am going to assume the following simple scenario:

- Fixed Rate Loan at 10% pa -Simple Monthly

- Loan Advance Value of £40,000

- Loan Term of 10 years (120 months)

In the first Illustration below - note how the Principal part of the Payment increases in the first 11 months of the Loan and the Interest decreases.

This is because the interest is calculated on the previous month's outstanding balance which is gradually decreasing.

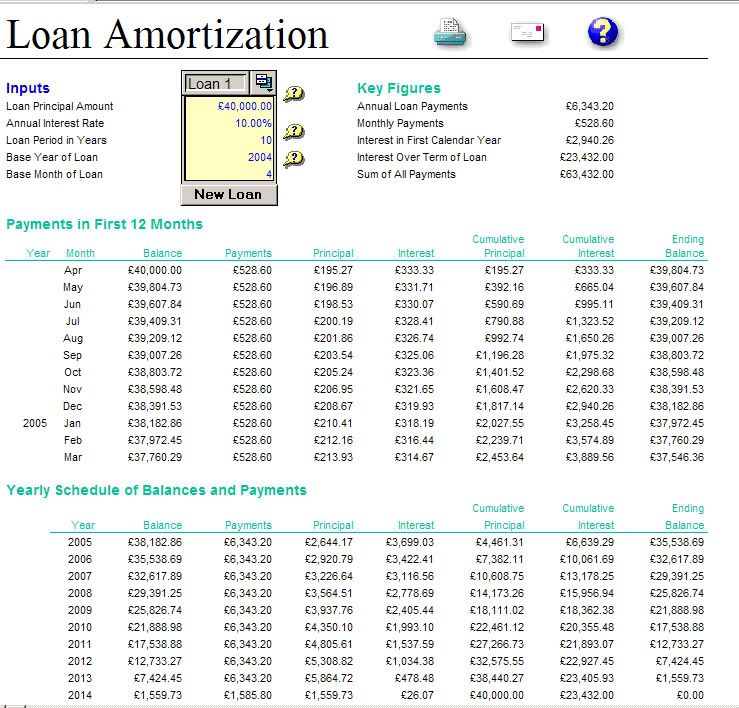

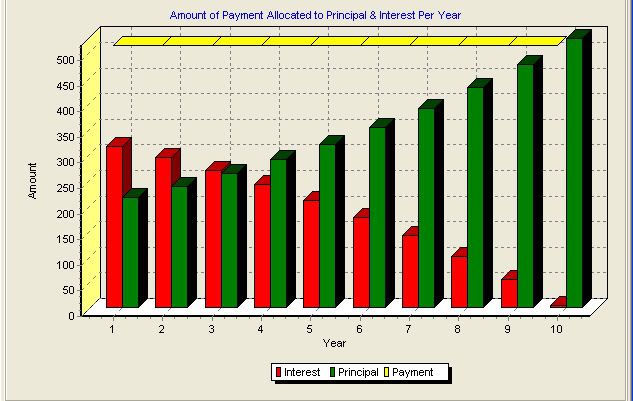

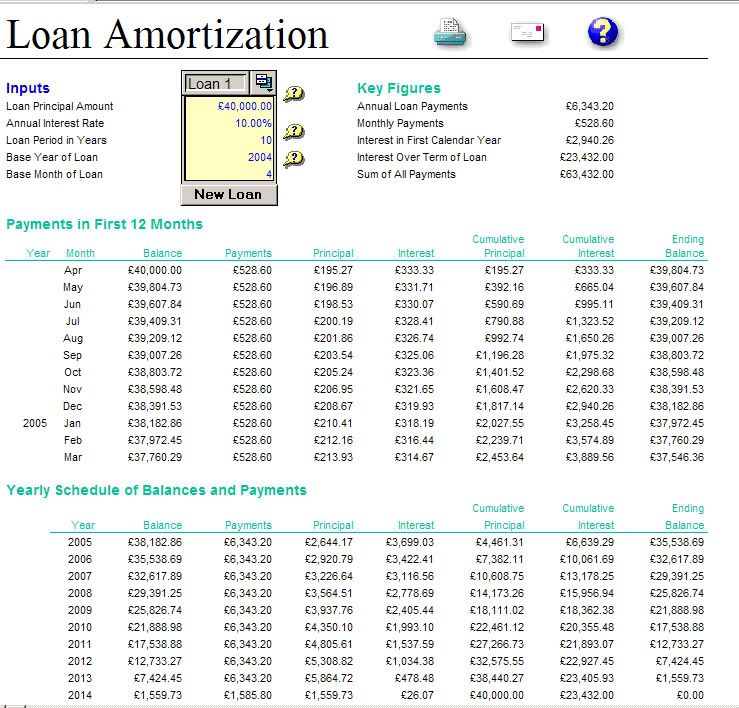

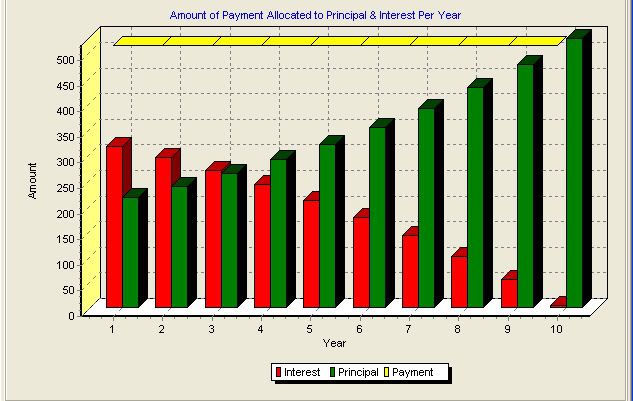

In the next illustration - note how the overall payment in the latter years of the loan moves towards mainly Principal and less Interest.

This is illustrated below which shows the part of the £528.60 monthly payment that is attributed towards paying off the loan and paying the interest on the loan - note how the ratio changes towards the end of the Loan.

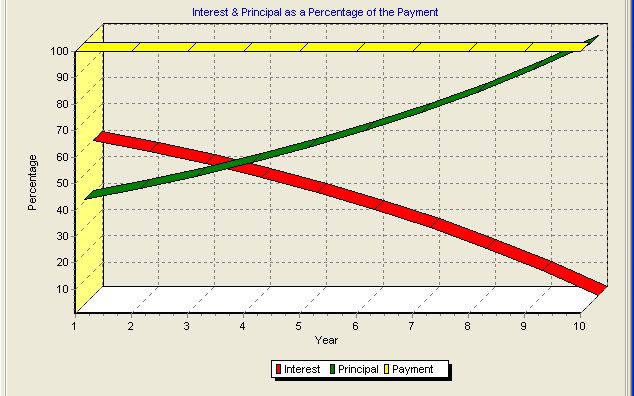

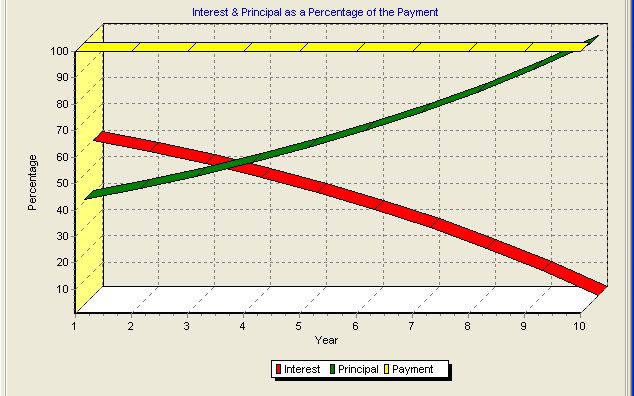

Similarly, another way of illustrating as a % of the monthly payment attributed to paying off the Loan and paying the Interest on the Loan.

Next, open up the PDF attachment below entitled Amort-1-40000-pdf

This is the full amortization schedule for the complete loan showing all 120 months payments and the outstanding balance of the loan at the end of each of those months.

This illustration was produced with the standard Excel Template which you will find under FILE|NEW|template on my computer|spreadsheet solutions|loan amortization.

The actual copy of the this illustration is also included below Amort-1-40000.xls for you to experiment with (if you are using Open Office-click on the file & SAVE it somewhere, then Open it after loading Open Office Calc-I have verified that OO will this read Excel file ok).

You can also experiment with your loans by entering your value/years/% and see it produce the monthly payment and schedule.

There is one small anomaly here I didn't mention earlier-these interest calculations usually work work with Annual Interest Rates (AIR) which is derived from the APR %'ge. The spreadsheet from the excel template uses Simple Interest

I am not going into the conversion factors in this thread-as I get confused myself--Bill is the master of interest calculations

But for your loan, just keep reducing the %'ge in easy stages until you get your correct monthly payment in the top r/h box. (to enter 9.5%-type .095, to enter 10%-type .10)--this then gives you a rough idea.

A further development on this theme was a spreadsheet where we modified the standard one to use APR/AIR and also provided a facility to vary the interest rate--see ----below

Comment