And the name of the Claimant on the repossession order is . . .

Announcement

Collapse

No announcement yet.

hi i need some urgent help and advice pls due to be evicted

Collapse

X

-

Re: hi i need some urgent help and advice pls

And the name of the Claimant on the repossession order is . . .

-

Re: hi i need some urgent help and advice pls

the loan is with harpmanor limited they are the same group as blemain ive had letters from blemain tooOriginally posted by PlanB View PostEven our Paul thinks you're talking about a loan from Blemain Finance because that was the title of your thread OTR and on LB

Leave a comment:

-

Re: hi i need some urgent help and advice pls

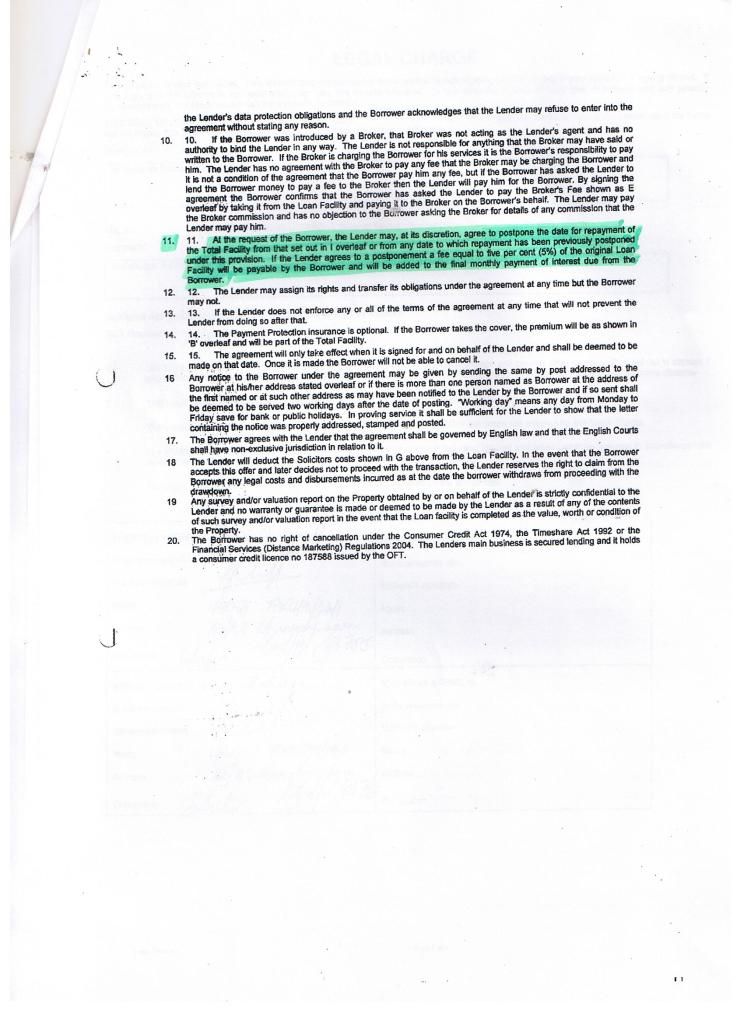

the only thing about consumer credit act is on paragraph 20 ??

Leave a comment:

-

Re: hi i need some urgent help and advice pls

Originally posted by PlanB View PostEven our Paul thinks you're talking about a loan from Blemain Finance because that was the title of your thread OTR and on LB

Thought it looked familiar.

Leave a comment:

-

Re: hi i need some urgent help and advice pls

Originally posted by PlanB View PostI'm having difficulty reading that email exchange on my screen but it looks as if the broker is simply touting for more business by suggesting that your brother should take out a mortgage through him (the broker) on his (brother) property to pay off your debt. That's one of the most outrageous and possibly unethical pieces of "advice" I've ever heard come out of a mortgage broker's mouth

No doubt he would be getting another fee for setting this up

No doubt he would be getting another fee for setting this up

Can you confirm whether Harpmanor or Blemain is the name of the creditor on your loan agreement and whether that agreement has 'Under the Consumer Credit Act' written anywhere on it. Without this information there's nothing more I can add at the moment

Thank you for your e-mail of 01:01 hrs. this morning (below).

I will get a fresh redemption statement for you from Harpmanor but I think you will find that my previous estimate of £100,000 valid to 11.10.2012 will be roughly correct.

As you know, Crystal Mortgages Ltd. is not a provider of residential mortgages and any business in this sector is outsourced to professional mortgage advisers whose remit is to give best advice and answer any questions.

The residential mortgage market has tightened up very considerably over the last few years and, from my limited knowledge, I know that mortgages need to have proof of income going back at least 2 years and the income multiplier is about 3 or 4 x proveable annual income.

The credit history also needs to be without any adverse registered for at least 3 years and a good reference would be required from the existing mortgage lender.

A self employed applicant would need to produce at least 2 years accounts.

This is why I suggested that your brother may be best placed to assist you by raising a re-mortgage on his existing domestic residence to produce net funds to the order of £100,000.

If he wishes to do this we will need his details and I will then pass on to a mortgage adviser who would provide him with individual mortgage advice.

The redemption statement for your above bridging loan will be forwarded soon. This will be valid to 11.10.2012. Please note that a further renewal fee of 5% will accrue to the account if not redeemed on or before 11.10.2012.

Please let me know if we can assist you

Leave a comment:

-

Re: hi i need some urgent help and advice pls

Even our Paul thinks you're talking about a loan from Blemain Finance because that was the title of your thread OTR and on LBOriginally posted by Paul. View PostIn need of some serious help! Blemain finance again!!!!

Is this your thread? how up to date is the info you are putting up here as the thread is dated 2010

Leave a comment:

-

Re: hi i need some urgent help and advice pls

That's nothing I've come across far worst, but saying that if the brother is happy to do it and it keeps a roof over their heads is it such bad advice???Originally posted by PlanB View PostI'm having difficulty reading that email exchange on my screen but it looks as if the broker is simply touting for more business by suggesting that your brother should take out a mortgage through him (the broker) on his (brother) property to pay off your debt. That's one of the most outrageous and possibly unethical pieces of "advice" I've ever heard come out of a mortgage broker's mouth

No doubt he would be getting another fee for setting this up

No doubt he would be getting another fee for setting this up

Can you confirm whether Harpmanor or Blemain is the name of the creditor on your loan agreement and whether that agreement has 'Under the Consumer Credit Act' written anywhere on it. Without this information there's nothing more I can add at the moment

I still must admit I can't quite get my head around this one.

Leave a comment:

-

Re: hi i need some urgent help and advice pls

You can see why I should be forgiven for getting confused about all thisOriginally posted by transformer999 View PostHi jimmyq...just out of curiosity can I ask if you check your credit file regular and if yes have Blemain ever entered a default against your file?

Blemain sent me default notice a few years ago and I check my file as regular as I can...and even though I have been paying again since Jan 12 they have not recorded this info...

Leave a comment:

-

-

Re: hi i need some urgent help and advice pls

My apologies, I missed this info at the bottom of your postOriginally posted by jimmyq View Postcan any of you write me some bullet points please so i can forward them to the fos

i really need to do something either write to fos and make my case stronger or write back to crystal and try get some info out of them

as for blemain and harpmanor they are both the same ive had letter from both but loan is with harpmanor limited If the loan is in the name of Harpmanor Ltd and you've already made a formal complaint to them you may now take this forward to the FOS. However I'm confused because I thought you had previously made a complaint to Blemain Finance

If the loan is in the name of Harpmanor Ltd and you've already made a formal complaint to them you may now take this forward to the FOS. However I'm confused because I thought you had previously made a complaint to Blemain Finance  Who is named as the Claimant on the court order for repossession please

Who is named as the Claimant on the court order for repossession please  From what you've just said I can only presume that it would be Harpmanor too - so I've lost the plot as to where Blemain come into all this

From what you've just said I can only presume that it would be Harpmanor too - so I've lost the plot as to where Blemain come into all this

There are sometimes ways to get possession orders 'unwound' but at the moment it's difficult to point you in the right direction without clarity on who is who in the chain of events

Leave a comment:

-

Re: hi i need some urgent help and advice pls

Any updates on this case???

Leave a comment:

-

Re: hi i need some urgent help and advice pls

Wonder what the FSA would view this comment by them??? guidelines come to mind!Originally posted by PlanB View PostI'm having difficulty reading that email exchange on my screen but it looks as if the broker is simply touting for more business by suggesting that your brother should take out a mortgage through him (the broker) on his (brother) property to pay off your debt. That's one of the most outrageous and possibly unethical pieces of "advice" I've ever heard come out of a mortgage broker's mouth

No doubt he would be getting another fee for setting this up

No doubt he would be getting another fee for setting this up

Can you confirm whether Harpmanor or Blemain is the name of the creditor on your loan agreement and whether that agreement has 'Under the Consumer Credit Act' written anywhere on it. Without this information there's nothing more I can add at the moment

Leave a comment:

-

Re: hi i need some urgent help and advice pls

I'm having difficulty reading that email exchange on my screen but it looks as if the broker is simply touting for more business by suggesting that your brother should take out a mortgage through him (the broker) on his (brother) property to pay off your debt. That's one of the most outrageous and possibly unethical pieces of "advice" I've ever heard come out of a mortgage broker's mouth

No doubt he would be getting another fee for setting this up

No doubt he would be getting another fee for setting this up

Can you confirm whether Harpmanor or Blemain is the name of the creditor on your loan agreement and whether that agreement has 'Under the Consumer Credit Act' written anywhere on it. Without this information there's nothing more I can add at the moment

Leave a comment:

-

Re: hi i need some urgent help and advice pls

can any of you write me some bullet points please so i can forward them to the fos as for crystal mortgages they are the ones who got me this loan and 5 years on are still in touch with me and know when and how much arrears im in etc. would you suggest i write to them asking them on what grounds they got me the loan on and what proof of income they had of mine to get me the loan etc ?

i sent them this reply this morning

and got this reply todayhi thanks for your support im trying to get a setllement figure off harpmanor to see how much they will take to settle ? also just out of curiosity what proof of income would you require do get another loan as last time if i remember correctly there was'nt much required as your company sorted most of it out ? can this be done again? if not whats required and what proff was required last time cant remember ?

Thank you for your e-mail of 01:01 hrs. this morning (below).

I will get a fresh redemption statement for you from Harpmanor but I think you will find that my previous estimate of £100,000 valid to 11.10.2012 will be roughly correct.

As you know, Crystal Mortgages Ltd. is not a provider of residential mortgages and any business in this sector is outsourced to professional mortgage advisers whose remit is to give best advice and answer any questions.

The residential mortgage market has tightened up very considerably over the last few years and, from my limited knowledge, I know that mortgages need to have proof of income going back at least 2 years and the income multiplier is about 3 or 4 x proveable annual income.

The credit history also needs to be without any adverse registered for at least 3 years and a good reference would be required from the existing mortgage lender.

A self employed applicant would need to produce at least 2 years accounts.

This is why I suggested that your brother may be best placed to assist you by raising a re-mortgage on his existing domestic residence to produce net funds to the order of £100,000.

If he wishes to do this we will need his details and I will then pass on to a mortgage adviser who would provide him with individual mortgage advice.

The redemption statement for your above bridging loan will be forwarded soon. This will be valid to 11.10.2012. Please note that a further renewal fee of 5% will accrue to the account if not redeemed on or before 11.10.2012.

Please let me know if we can assist you further.

i really need to do something either write to fos and make my case stronger or write back to crystal and try get some info out of them

as for blemain and harpmanor they are both the same ive had letter from both but loan is with harpmanor limited

Leave a comment:

Leave a comment: