Re: Fred Bassett v Arrow Global

I wouldn't respond to Bryan carter unless they send you something...then post up here.

I've seen Bryan Carter off on 2 of my debts.

Announcement

Collapse

No announcement yet.

Fred Bassett v Arrow Global

Collapse

X

-

Re: Fred Bassett v Arrow Global

I have wondered about this. MBNA left this alone for 4 years and didn't go anywhere near a court. During this time I saw off Iqor, AIC, Aegis, Wescot and about 18 "Heads of Customer Assistance" at MBNA.

I shouldn't be worried, but nonetheless, when Carter appears on the scene it's time to be wary.

I won't be completely comfortable with this until the end of next year when it becomes SB.

Anyway, can I take it that there is no longer a need to respond to Carter?

Regards to all.

Fred

Leave a comment:

-

Re: Fred Bassett v Arrow Global

Nice one Fred

What a coincidence about the address!

Leave a comment:

-

Re: Fred Bassett v Arrow Global

Carters is also gone. That said, they can't "continue" to process your data as they've returned the account.

We'll come back to that later. Just chill for now.

Well done

Leave a comment:

-

Re: Fred Bassett v Arrow Global

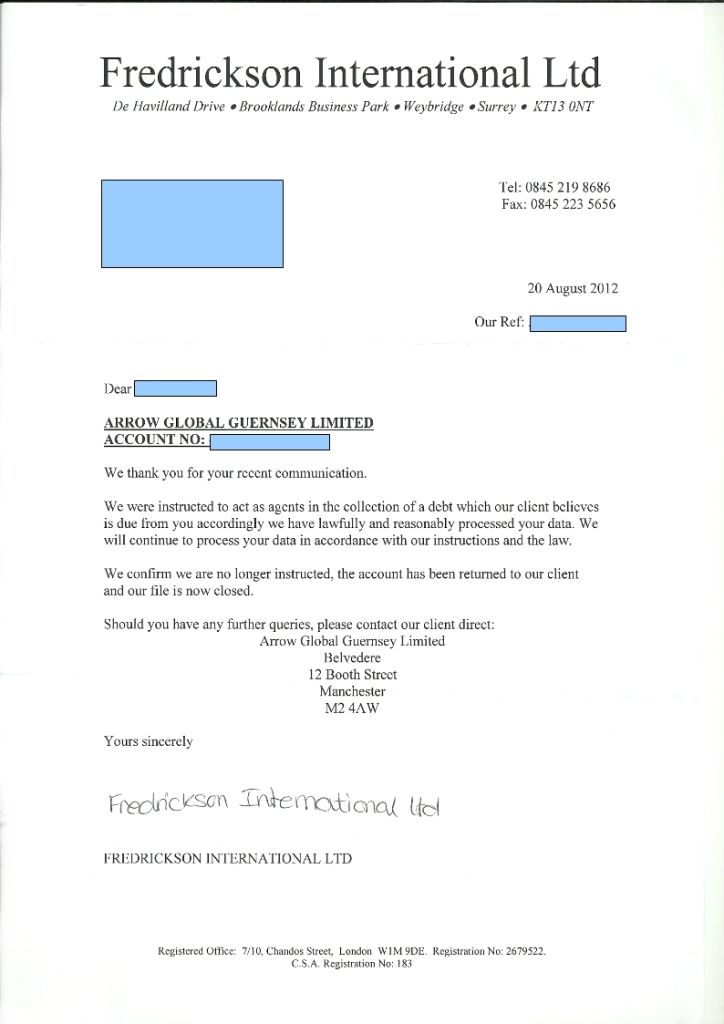

Well right or wrong template it seems to have been enough to see Fredericksons off:

I'm amazed at this to be honest - of all the DCAs I've had to deal with, they are by far and away the most aggressive and I can't believe they've given up that easily. The question is, they've gone, but will Carter go with them?. Carter's letter stated that I must contact Freds, so I'm not sure where I stand now.

Anyway, on a completely different note: The address on the bottom of Fred's letter is 7/10 Chandos Street London W1. By happy coincidence, that happens to be the office where I met Mrs Bassett 30 years ago!

Regards to all.

Fred

Leave a comment:

-

Re: Fred Bassett v Arrow Global

I think ours should be sent to Carers Niddy.

Leave a comment:

-

Re: Fred Bassett v Arrow Global

Looks like an older version of ours - we update ours whenever new legislation etc comes out. Hence we brag we have the best template selection of all forumsOriginally posted by Fred Bassett View PostAh, I just realised that I sent off a template letter from another site by mistake. It is still a response to an LBA. Hope I haven't boobed. This is what it says:

This is in acknowledgement of your letter dated 8th August 2012 the contents of which have been duly noted.

Further to you stressing that county court proceedings will be actioned by yourselves should I fail to make contact in regard to alleged sums outstanding and allegedly owed by me on the above account, I remind you of Civil procedure rules protocols. Nevertheless in my response to your letter please be advised of the following.

I put forward that you now have a requirement to provide me with:

1. A true copy of the executed credit agreement and any terms and conditions that applied to the account at the time of default and at the time the account was opened. Please note that a "true copy" as defined by the Consumer Credit Act will not be acceptable in this case, and a copy of the actual executed agreement, including signature, is required.

2. All records you hold on me relevant to this case, including but not limited to:

1. A transcript of all transactions, including charges, fees, interest, payments and both the amounts of credit and any repayments made to the account.

2. Transcriptions of all telephone conversations recorded and any notes made in relation to telephone conversations

3. Where there has been any event in the account history over this period that has required manual intervention by any person, disclosure of any indication or notes that have either caused or resulted in that manual intervention, or other evidence of that manual intervention in relation to the account previously held by me with Goldfish Bank is required.

4. True copies of any notice of assignment and/or default notice or enforcement notice that you sent to me, with a copy of any proof of postage that you hold.

5. Documents relating to any insurance added to the account, including the insurance contract and terms and conditions, date it was added and deleted (if applicable).

6. Details of any collection charge added to the account; specifically, the date it was levied, the amount of the charge, a detailed financial breakdown of how the charge was calculated, and what the charge covers.

7. Specific details of the fees/charges levied by any other agency in respect of this account and a detailed breakdown of said fees/charges and what each charge relates to and on what date said fees/charges were levied.

8. A genuine copy of any notice of fair use of my data as required by the Data Protection Act 1998.

9. A list of third party agencies to whom you have disclosed my personal data and a summary of the nature of the information you have disclosed.

1. Copies of statements for the entire duration of the credit agreement.

I make this request to ensure that each party has equal footings which can allow action to proceed speedily, fairly and without undue costs or waste of courts time, as defined within Pre-action Practice Directions -Protocols 4.6 of the Civil Procedures Rules.

I will give you 14 days to respond with the above, failure to comply will result in a complaint being made to the Court, should this become necessary, and in addition to the fos for any breaches of OFT and CCA codes. This includes breaches as a result of initiating a County Court claim where failing to provide or produce documents make litigation improper..

Specifically this relates to one or any number of the following:

1. demand any payment on the account, nor am I obliged to offer any payment to you.

2. add any further interest or charges to the account.

3. pass/sell the account or outstanding balance to any third party.

4. register any information in respect of the account with any of the credit reference agencies.

5. issue a default notice related to the account.

Furthermore, reserve my right to make a copy of this letter available for inspection to the Court and Financial/Consumer regulators should you fail to comply with this request.

I await your response.

Yours faithfully

Regards.

Fred

Leave a comment:

-

Re: Fred Bassett v Arrow Global

Cheers Vint, will do.Originally posted by vint1954 View PostIndeed Fred, however they are in response to different letters. I would still send the template to keep things on track here.

Regards.

Fred

Leave a comment:

-

Re: Fred Bassett v Arrow Global

Indeed Fred, however they are in response to different letters. I would still send the template to keep things on track here.Originally posted by Fred Bassett View PostUnfortunately vint, I've already send it by recorded delivery. I need to do a bit of sorting out. I've got templates stored for handy reference but I've made a cock-up somewhere. Still, I think it says pretty much the same thing.

Regards.

Fred

Leave a comment:

-

Re: Fred Bassett v Arrow Global

Well I say I've already sent it - I actually sent it to Freds, not Carter. I'll just refer Carter to my letter to them rather than confuse things at this point.

Regards.

Fred

Leave a comment:

-

Re: Fred Bassett v Arrow Global

Unfortunately vint, I've already send it by recorded delivery. I need to do a bit of sorting out. I've got templates stored for handy reference but I've made a cock-up somewhere. Still, I think it says pretty much the same thing.Originally posted by vint1954 View PostOOOPs,

I think you need to send Our Templates | Unenforceability Templates | Threat by Creditor - Threat-o-Gram Letter Before Action

Just refer to their letter dated 15th August.

Regards.

Fred

Leave a comment:

-

Re: Fred Bassett v Arrow Global

OOOPs,

I think you need to send Our Templates | Unenforceability Templates | Threat by Creditor - Threat-o-Gram Letter Before Action

Just refer to their letter dated 15th August.

Leave a comment:

-

Re: Fred Bassett v Arrow Global

Ah, I just realised that I sent off a template letter from another site by mistake. It is still a response to an LBA. Hope I haven't boobed. This is what it says:

This is in acknowledgement of your letter dated 8th August 2012 the contents of which have been duly noted.

Further to you stressing that county court proceedings will be actioned by yourselves should I fail to make contact in regard to alleged sums outstanding and allegedly owed by me on the above account, I remind you of Civil procedure rules protocols. Nevertheless in my response to your letter please be advised of the following.

I put forward that you now have a requirement to provide me with:

1. A true copy of the executed credit agreement and any terms and conditions that applied to the account at the time of default and at the time the account was opened. Please note that a "true copy" as defined by the Consumer Credit Act will not be acceptable in this case, and a copy of the actual executed agreement, including signature, is required.

2. All records you hold on me relevant to this case, including but not limited to:

1. A transcript of all transactions, including charges, fees, interest, payments and both the amounts of credit and any repayments made to the account.

2. Transcriptions of all telephone conversations recorded and any notes made in relation to telephone conversations

3. Where there has been any event in the account history over this period that has required manual intervention by any person, disclosure of any indication or notes that have either caused or resulted in that manual intervention, or other evidence of that manual intervention in relation to the account previously held by me with Goldfish Bank is required.

4. True copies of any notice of assignment and/or default notice or enforcement notice that you sent to me, with a copy of any proof of postage that you hold.

5. Documents relating to any insurance added to the account, including the insurance contract and terms and conditions, date it was added and deleted (if applicable).

6. Details of any collection charge added to the account; specifically, the date it was levied, the amount of the charge, a detailed financial breakdown of how the charge was calculated, and what the charge covers.

7. Specific details of the fees/charges levied by any other agency in respect of this account and a detailed breakdown of said fees/charges and what each charge relates to and on what date said fees/charges were levied.

8. A genuine copy of any notice of fair use of my data as required by the Data Protection Act 1998.

9. A list of third party agencies to whom you have disclosed my personal data and a summary of the nature of the information you have disclosed.

1. Copies of statements for the entire duration of the credit agreement.

I make this request to ensure that each party has equal footings which can allow action to proceed speedily, fairly and without undue costs or waste of courts time, as defined within Pre-action Practice Directions -Protocols 4.6 of the Civil Procedures Rules.

I will give you 14 days to respond with the above, failure to comply will result in a complaint being made to the Court, should this become necessary, and in addition to the fos for any breaches of OFT and CCA codes. This includes breaches as a result of initiating a County Court claim where failing to provide or produce documents make litigation improper..

Specifically this relates to one or any number of the following:

1. demand any payment on the account, nor am I obliged to offer any payment to you.

2. add any further interest or charges to the account.

3. pass/sell the account or outstanding balance to any third party.

4. register any information in respect of the account with any of the credit reference agencies.

5. issue a default notice related to the account.

Furthermore, reserve my right to make a copy of this letter available for inspection to the Court and Financial/Consumer regulators should you fail to comply with this request.

I await your response.

Yours faithfully

Regards.

Fred

Leave a comment:

-

Re: Fred Bassett v Arrow Global

I sent them this one: Threat by Creditor - Threat-o-Gram Letter Before Action - I have a copy on my hard drive.Originally posted by vint1954 View PostFred,

Which template are you referring to.

Also, you do not have to defend yourself at this stage. I'm sure he would like to see your defence before he decides to go to court.

Cheers.

Fred

Leave a comment:

-

Re: Fred Bassett v Arrow Global

Fred,

Which template are you referring to.

Also, you do not have to defend yourself at this stage. I'm sure he would like to see your defence before he decides to go to court.

Leave a comment:

Leave a comment: